In the pay yourself first budget people first save at least 20% of their net income, and then freely spend the remaining 80%.

Pay yourself first method (80/20 budget) 50% of one's net income then goes towards needs, 30% towards wants, and 20% towards savings. The 50/30/20 budget is a simple plan that sorts personal expenses into three categories: "needs" ( basic necessities), "wants", and savings. These steps can help individuals gain better control over their finances and achieve their financial goals. This method involves assessing one's financial situation, setting realistic financial goals, allocating income, tracking spending and adjusting the budget, and regularly reviewing and revising the budget. There exist many methods of budgeting to help people do this. In the most basic form of creating a personal budget the person needs to calculate their net income, track their spending over a set period of time, set goals based on the information previously gathered, make a plan to achieve these goals, and adjust their spending based on the plan. People who budget their money are less likely to obtain large debts, and are more likely to be able to lead comfortable retired lifes and to be prepared for emergencies. Having a budget can help people feel more in control of their finances and make it easier for them to not overspend and to save money.

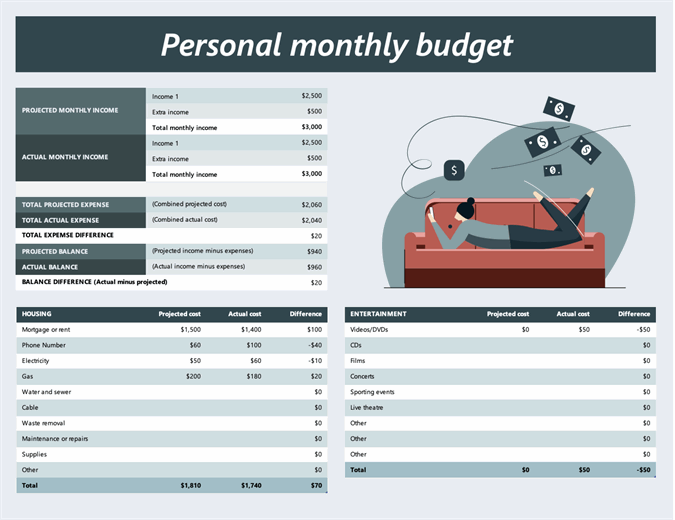

Personal budgets are usually created to help an individual or a household of people to control their spending and achieve their financial goals. A personal budget (for the budget of one person) or household budget (for the budget of one or more person living in the same dwelling) is a plan for the coordination of the resources (income) and expenses of an individual or a household.

0 kommentar(er)

0 kommentar(er)